1) Home Energy Conservation (HEC) Program:

This program helps Ontario homeowners improve the energy efficiency of their homes through $1600 worth of incentives. The program is run by Enbridge and includes a variety of eligible appliances, HVAC and home energy updates.

If you are thinking of updating your furnace, doing a basement renovation or wanting to improve the efficiency of your HVAC system, this program can help offset the costs.

Here’s how to qualify for the incentive:

Step 1: Sign-Up

Visit https://enbridgesmartsavings.com/ and enter your postal code. After answering three questions Enbridge will tell you if you are eligible. If you are, Enbridge will direct you to contact a Registered Energy Advisor to schedule a phone call and discuss the HEC Program.

Step 2: Schedule Energy Pre-Audit

Your Registered Energy Advisor will setup an appointment to conduct a pre-energy audit on your home. You have to pay the upfront cost of the audit ($250) and get a report on the energy efficiency of your home along with opportunities for updates and renovations.

Step 3: Complete Home Energy Renovations

Complete the qualifying home renovations to improve the energy efficiency of your home. These can include a furnace upgrade, sealing windows better, new insulation, HVAC updates and more. The minimum is two qualifying updates and a 15% increase in efficiency.

Step 4: Schedule Energy Post-Audit

When updates are complete schedule your post-audit with your energy advisor. This will cost $175 – $600 upfront, but upon completion, if you achieve the 15% increase in efficiency the $5000 rebate will offset this cost.

Step 5: Receive Check in Mail

After the energy post-audit is complete you will receive your cheque in the mail.

You can learn more about this program by visiting the Ontario Home Energy Conservation website.

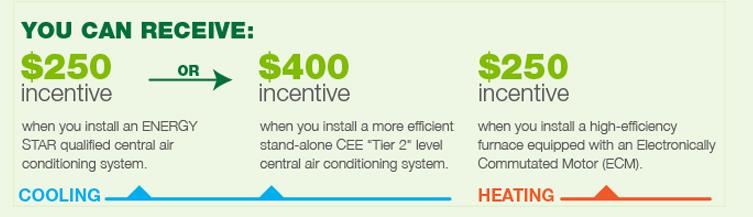

2) Save-on Energy Rebates

This is a perfect program for homeowners thinking of doing a new kitchen or basement renovation and replacing old inefficient appliances.

The rebate program includes a range of incentives with different rebate amounts for each appliance. For example, refrigerators, washers and freezers are eligible for $75, while larger HVAC upgrades like furnaces and heat pumps can provide up to $4,000 in rebates.

How to use the Save on Energy program?

Ottawa homeowners can take advantage of the ENERGY STAR appliance rebate by following these steps:

Step 1: Visit SAVE ON website

The website has a section for homeowners with details on the program including eligible equipment and appliances in your home.

Step 2: Contact SAVE ON energy advisor

Call 1-855-591-0877 OR apply online at SaveOnEnergy.ca/EAP

An advisor will discuss your eligibility requirements, depending on the outcome you may receive either a ‘Energy Saving Kit’ OR an energy expert may visit your home to see what upgrades will help you most.

Step 3: Audit and Incentives

Talk to your Energy Advisor about your situation, intended upgrades, and the total amount of available incentives. They will let you know if conducting an energy audit and taking advantage of the incentives and rebates makes sense for your situation. You can learn more about the full details of this program here: https://saveonenergy.ca/. Incentives and rebates will be added and changed for 2021

3) Residential Protective Plumbing Program (RPPP):*

Note: Only for Ottawa homeowners

The record rainfall in Ottawa this year caused trouble for many homeowners’ basements. But most issues can be avoided with some proactive basement maintenance and knowledge of your home’s plumbing infrastructure.

Plus the City of Ottawa’s RPPP—a municipal rebate program—is setup to support homes susceptible to basement flooding.

The RPPP works by providing over $2,000 in rebates to basement flood prevention equipment including backwater valve installation, sump pumps and building permits for the renovation activities.

Are you eligible to take advantage of the RPPP program?

Here are the two major RPPP eligibility requirements for City of Ottawa homeowners:

- Home built before January 1, 2004 for protective plumbing work related to the private storm sewer services

- Home before January 1, 2012 for protective plumbing work related to private sanitary sewer services

Further details on eligibility for the RPPP can be found here.

How does RPPP help protect your home from basement leaks?

The diagram below shows how water can enter your basement from the city’s sewer systems. If your home was built prior to 2004, updating the protective plumbing equipment is a good safety measure and may lower your insurance.

Diagram shows how water can enter your home through City of Ottawa’s water and sewer infrastructure

How to take advantage of the RPPP Rebate?

Here are the seven steps to take advantage of the RPPP rebate.

Step 1: Submit Your Application

Visit the City of Ottawa’s RPPP website and follow the instructions. This will include a detail of proposed work plus a quote for the renovation and infrastructure update.

Step 2: City will review your RPPP application

The city will review your RPPP application and contact you with any questions, next steps, and your assigned RPPP file number.

Step 3: CCTV Inspection

The next step, your basement renovation contractor will a perform a CCTV inspection of the sewer lateral from inside the home to the city sewer at street level—then submit this recording to the City of Ottawa

Step 4: Site Visit

The city will conduct a free of charge site visit to confirm protective plumbing is required.

Step 5: Site Visit Review + Building Permits

After the site visit is complete you will receive a review. At this time you can have your renovation contractor apply for building permits and prep for proposed work.

Step 6: Equipment Installation:

Your contractor can begin the installation of protective plumbing devices, foundation repair and basement waterproof—depending on your situation.

Step 7: Rebate Processing

After work is complete and paid in full, you submit the final piece of the RPPP application and receive your rebate cheque!

If you found your basement leaking, the RPPP might be a good opportunity to offset the costs of foundation repair and basement waterproofing depending on your situation.

4) HST New Housing Rebate

If you are planning a major renovation, home addition or converting a non-residential property into a home, you may be eligible for up to $30,000 HST rebate.

But of course, with a rebate this large, there are strict conditions and processes to follow in order to qualify for the full rebate. Read below to see if this program is right for you:

Who qualifies for the HST new housing rebate?

The Canada.ca website has full program eligibility details on the HST new house program. If you are planning on doing any of the following in Ontario, you may qualify:

- Build a house

- Contract someone to build a house

- Substantially renovate a house or condominium

- Contract someone to extensively renovate a home or condo

- Add a major addition to a home

- Rebuild a home that was destroyed by fire

- Convert a non-residential property into a home

How to calculate new housing HST rebate for home renovations?

The best way to calculate your HST rebate amount is to visit the Canada.ca FAQ section on claiming your HST rebate. On it they provide a range of a variety of calculation worksheets depending on your specific situation.

For example, if you hired a renovation contractor to build a new home addition that doubled the living area in your house you would qualify for the rebate and use this GST calculation form—which itemizes all expenditures—to calculate the total amount.

How to apply for the HST housing rebate?

If individual homeowners are comfortable filing their own taxes and navigating CRA forms, they can apply for the HST housing rebate themselves. But you can only apply for this program once.

If you are planning on doing a major home renovation, such as adding an addition or gutting an old home to do a full renovation—the HST housing program may be right for you.

5) Home Accessibility Tax Credit (HATC):

Are you eligible for the home accessibility tax credit?

If you are 65 years or older, or claim the disability tax credit then you qualify for the HATC program for eligible renovations on your principal residence.

What is the qualifying home renovation for the HATC?

If you plan on making a permanent change to your home, like removing a staircase in place of a ramp or installing an accessible bathroom on the main floor you qualify for the HATC.

How to Access: VISIT HATC PROGRAM WEBSITE HERE

6) Home Appliance Tax Credit

A 15% tax credit to cover the cost of home appliance repairs was introduced by the Liberal government in 2021. The goal of the program is to reduce appliances ending up in landfills and support homeowners when major appliances require repair.

The tax credit covers expenses up to $500. It was introduced in 2022 and is till active

How to apply: VIST THE HATC PROGRAM WEBSITE HERE

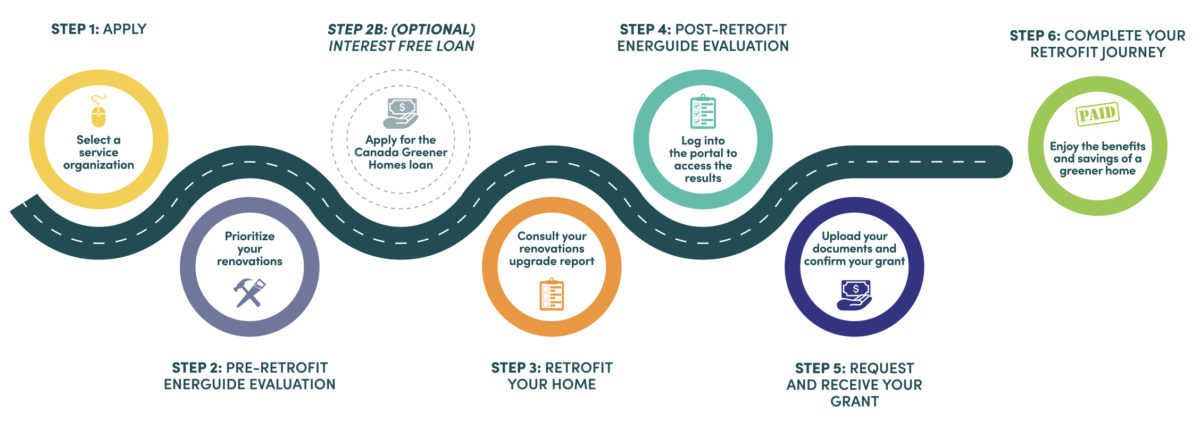

7) Canada Greener Homes Grant and Loan Programs:

Are you looking to upgrade your home to make it more energy-efficient and lower energy costs? The new Canada “Greener Homes” program can financially support you.

Update February 2024: The Greener Home Grant is closed to new applicants, but the Green Homes Loan is Available.

There are two parts of the program:

- Grant: Up to $5000 for home retrofits

- Loan: Interest-free loan of up to $40,000 for retrofits

Where to Apply? Visit the program website here

The chart below shows the process of getting started with the Greener Homes Program

The tax credit covers expenses up to $500. It was introduced in 2022 and is till active

How to apply: VIST THE HATC PROGRAM WEBSITE HERE